Advanced Search

Your search results

Blog Archives

The Best U.S. City To Retire With No Savings

According to a GoBankingRates survey, one-third of Americans have $500 or less saved, meaning if they were to retir [more]

Continue Reading

California Home Prices Highest In 15...

According to the California Association of Realtors, the statewide medium home price registered its biggest year-over-year gain in 15 months. What does this mean? Buyers and Sellers: There is solid in [more]

Continue Reading

Negotiating Home Repair Costs

In a buyers market sellers may be willing to negotiate repairs then in a sellers market. However, this can be very [more]

Continue Reading

The Top 3 Homebuyer Must Haves For 2023

We can look forward to what we want in a home, depending on what was being created late into 2022. According to new [more]

Continue Reading

List Price Decreases!

If you are thinking of selling, good real estate practice suggests you should list for what a comparable sold prope [more]

Continue Reading

HEART First Time Homebuyer Workshop

HEART of San Mateo County (Housing Endowment and Regional Trust) has a virtual first-time homebuyer workshop where [more]

Continue Reading

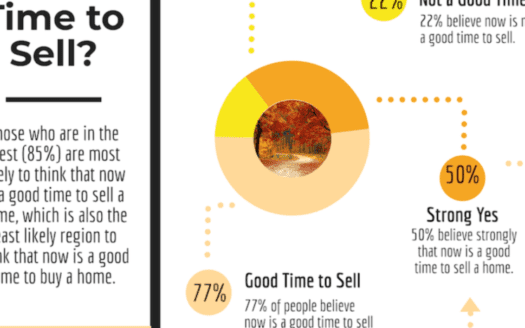

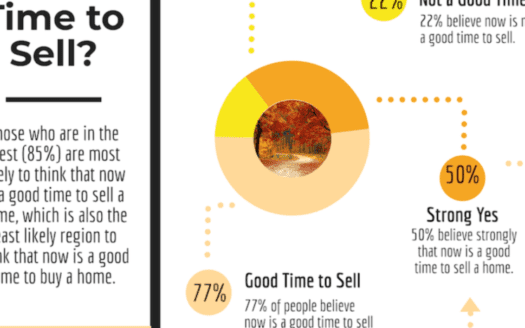

Why 85 Percent Say It’s Time To Sell

According to a recent survey, it’s a really good time to sell a house. 77% of consumers say so, which is a record h [more]

Continue Reading

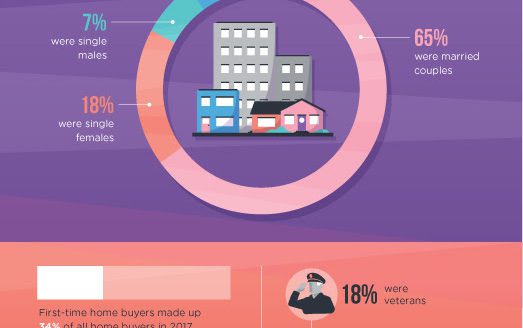

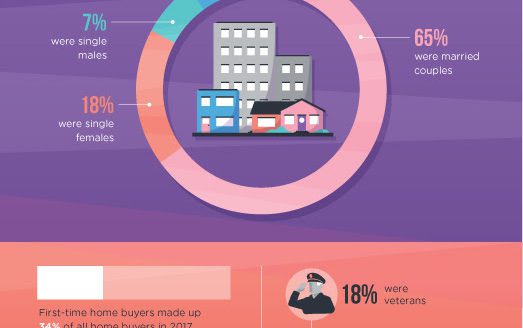

Who Bought Homes in 2017??

Are you next? What does it take to get ready to buy a home in 2018? How can you qualify? Where do you get that elus [more]

Continue Reading

The Hottest Markets of 2017

At Realtor.com, they identify the country’s hottest metropolitan markets for real estate—those homes that att [more]

Continue Reading

More Single Women Own Homes

According to a new analysis by Owners.com, the Midwest is attracting more single and unmarried women who are choosi [more]

Continue Reading