Are mortgage rates going up, making it harder to qualify for a purchase loan? Rates did move up slightly this week, but buyers have great news. Freddie Mac economists revised their forecasts this week to predict 30-year fixed-rate mortgages to average below the 5 percent threshold for at least the NEXT TWO YEARS!

The current housing market, with lower levels of homes sold, has become very mortgage rate sensitive. According to Sam Khater, Freddie Mac’s chief economist, applications for purchase loans fell this week. However, the spring buying season is coming real soon. How does it look?

Khater says: “…softening house price appreciation along with increasing inventory of homes on the market—and historically low mortgage rates—should give a boost to the spring homebuying season.”

Awesome news, more houses coming on the real estate market for sale, historically low rates, motivated sellers willing to accept lower acceptance prices and a very strong economy. Sounds like a very good time to be a buyer!

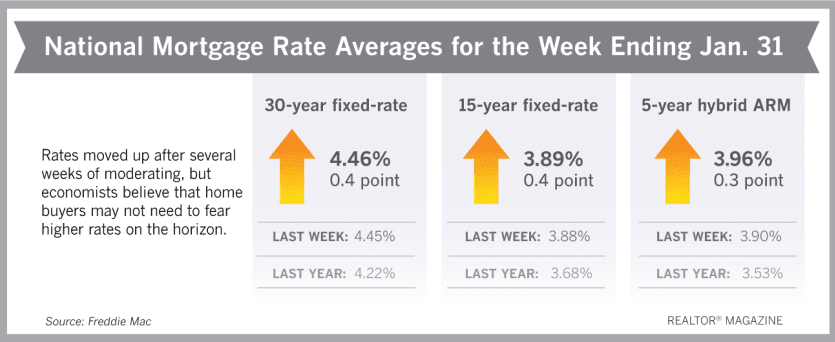

Here are the national averages with mortgage rates for the week ending Jan. 31:

30-year fixed-rate mortgages: averaged 4.46 percent, with an average 0.5 point, rising from last week’s 4.45 percent average. Last year at this time, 30-year rates averaged 4.22 percent.

15-year fixed-rate mortgages: averaged 3.89 percent, with an average 0.4 point, increasing from last week’s 3.88 percent average. A year ago, 15-year rates averaged 3.68 percent.

5-year hybrid adjustable-rate mortgages: averaged 3.96 percent, with an average 0.3 point, rising from last week’s 3.90 percent average. A year ago, the 5-year ARM averaged 3.53 percent.