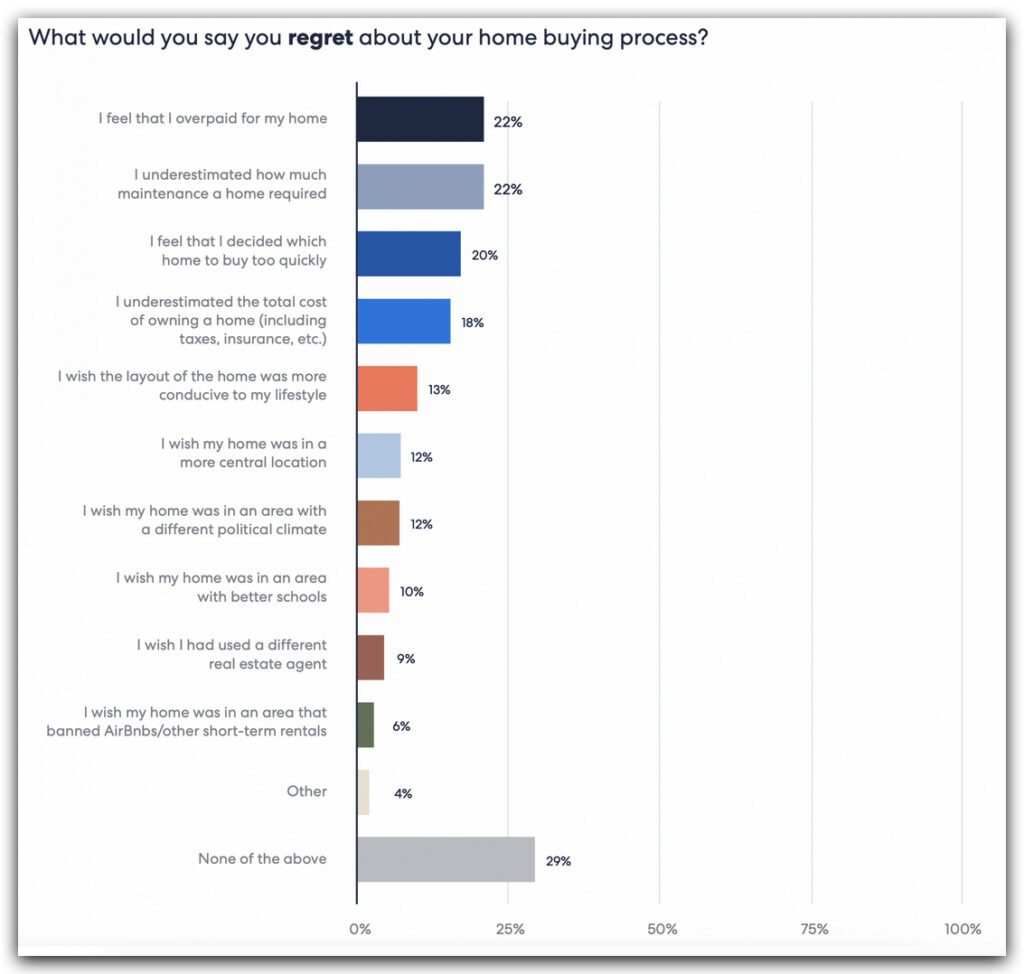

Buyer’s Remorse is associated with buying an expensive item…like a house. An article from HomeLight reveals what the reasons are for the remorse. However, what can you do to NOT get it in the first place?

Here are my top 7 ways on reducing or eliminating “Buyer’s Remorse.”

- Create a budget and over-budget before buying a house. Will you be using the entirety of what the lender is willing to lend you for a home and will you use all of it or most of it?

- How much to bid over? Be practical on how much you are willing to go over the value of the house, NOT the list price. Make sure you work with your Realtor to see what the house is worth on the open market, since the List Price is most likely a marketing factor. Find out from a Comparable Market Analysis where the home value is at and going in the near future.

- Work with experienced professionals. Starting with a Realtor that has gone through the process and can point out the good and the bad. Have an experienced Home Inspector to point out any near and future costs associated with fixing the house. When will you have to start spending money on the house, the day after closing, or years down the road? When will you have to replace the roof, in 2 years or 20 years, how old is the heating unit or air conditioning unit? How much will taxes and insurance be? Consider knowing the maintenance costs as part of the buying process, NOT when you have closed the deal sitting in your living room couch and having buyer’s remorse.

- Don’t buy a total remodel. Can you buy a house that needs some work, not totally updated, where you can do the work yourself, or with your favorite contractor and get the upgrades YOU want in YOUR house? For example, I helped my clients buy a house that needed some work, bathrooms were fine, lot was fine but had a dreadful, outdated kitchen. They bought the house a little bit under current value, spent about $12,000 on an updates for their kitchen, and now LOVE their house!

- Play the Game. You may still get buyer’s remorse. Even if the house you are to purchase checks off a lot of what you were looking for, it is common for buyers to have second thoughts on if they paid too much, for example. I have a “game” I play with my buyers to make sure they will be ok with their purchase price. It makes them think on what they are willing to offer before I even submit their initial offer. I can show you how.

- Get a good loan. Understand the type of home purchase loan you are getting. Since you will be needing a pre-approval loan as part of your offer package, know for sure the short and long term financial implications of the loan. Will your monthly payment go up or stay the same for the duration of the loan? Is a 10 or 15 year loan preferable?

- Future Value. Look at the long term consequences and benefits of owning your home. What were the selling prices 2 years ago? 5 years ago? 10-20 years ago? When you look at your home as a place for you and your family and a major instrument for building future wealth, it can help with the initial economic sting of your purchase. For example, my mom and dad bought their house in 1970 and half of their income went to paying the mortgage of the house. Back then $24k was a lot of money, nice that today home selling prices in the neighborhood are at $1.7 million!

Contact me to see how I can help you get your home and have as little buyer’s remorse as possible.