How? Your credit score matters. Generally speaking, the higher your credit score, the better you can get approved for a lower interest rate saving you thousands of dollars in interest charges, according to FICO. For example, if you have a credit score over 760 you can lock in a 30-year fixed rate mortgage of 5.75%. But if you have a credit score of 640 or below your rate jumps to 7.3%. On a $300,000 loan paying that higher interest rate adds up to an extra $113,000 over the lifetime of the loan.

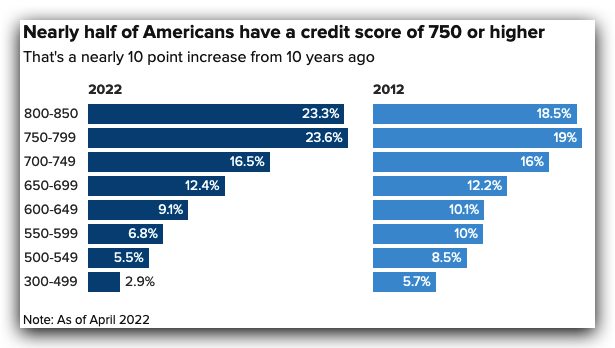

How to improve your score and save money? Pay your bills on time and reduce your credit card balance. Keep your revolving debt below 30% of your available credit and ask for a higher credit limit. You can also make an extra payment in the middle of the billing cycle. Note that nearly half of Americans have a credit score of 750 or higher. That’s a near 10-point increase from 10 years ago and shown on the graph here.