According to Fannie Mae, single-family home sales likely bottomed out in these past three months. They are expected to begin a slow and meaningful recovery over the year 2024. Currently mortgage rates dropped below 7% and a year ago at this time the 30-year fixed rate mortgage rate average was 6.31%. This is welcome news and as inflation continues to decelerate the housing market will begin to pick up. This, of course has a lot to do with what buyers can afford as many are currently priced out.

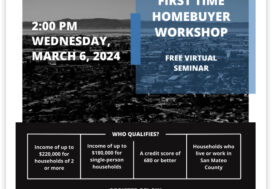

What Can You Do NOW? Please don’t wait until mortgage rates drop even lower and even more buyers come back to the market, making it harder to purchase a home. Buyers on the sidelines will make their way back, bringing back multiple offers and least favorable buyer terms. This can make selling prices creep back up, which all-in-all makes the buying experience even more frustrating. Prepare now find out what you can qualify for and as soon as rates drop more, you will be able to qualify for more in terms of a purchase money loan. Let me know if you would like to be directed to a well-qualified lending professional. The picture here is a lower-priced duplex in San Jose (live in one, rent the other!).