Mortgage rates have a direct impact on what a potential buyer qualifies for. Real estate 101 says the higher the rate goes the more expensive a mortgage payment is, and the harder it is to qualify for a loan. Raising rates make the monthly loan payment higher, and thus a buyer qualifies for less money to borrow.

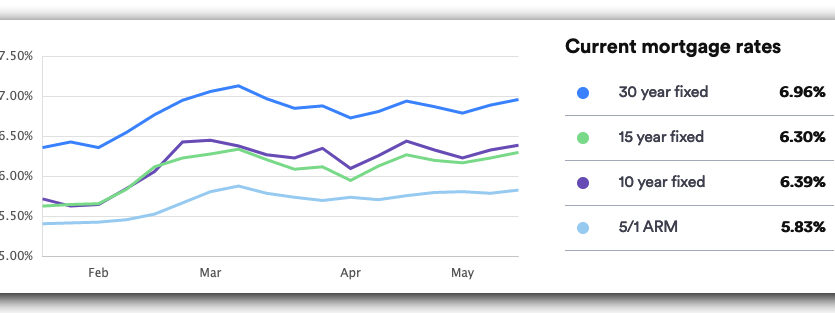

Today’s Interest Rates. After weeks of declines, the interest rate for a 30-year mortgage jumped to 6.99% average this week. According to Sam Khater, Freddie Mac’s chief economist, home prices have stabilized, but with supply tight and interest rates above 6%, affordable housing is a serious issue for homebuyers. He states that unless interest rates drop into the mid 5% range, demand will only modestly recover.

The Sweet Spot. Accordingly, in a recent study by John Burns, Real Estate Consulting, 71% of buyers say they will buy when interest rates are at 5.5% or lower. The National Association of Realtors forecast that mortgage rates will drop below 6% by the end of this year.

We can expect rates to continue to fluctuate in the coming months, which directly affect, housing, affordability, and thus sales activity.

What Can Buyers Do Now? Many buyers continue to compare the current high interest rates of 6.9% to the 3% of early 2022. Unfortunately, all economic forecasts show 3% will never come around again. Some things sellers can do: Look for sellers that will temporarily give 5% for the first year and on year 2 have the rate go to current. Have sellers pay for some closing costs, especially on those properties that are not selling. Buying points to reduce the interest rate can also help as well as looking into an interest only loans, but only for the short term.

When Rates Go Down: Once interest rates go down and hit that sweet spot, expect more competition for available inventory, which is forecast to remain tight, resulting in multiple offers and higher sales prices. Please Do Not wait until that happens, “date the rate but marry the home” is a good way to look at the current real estate market. Get your home, pay a little more now in monthly payments and expect rates to go down, and home prices to continue to go gradually up.