Advanced Search

Your search results

Blog Archives

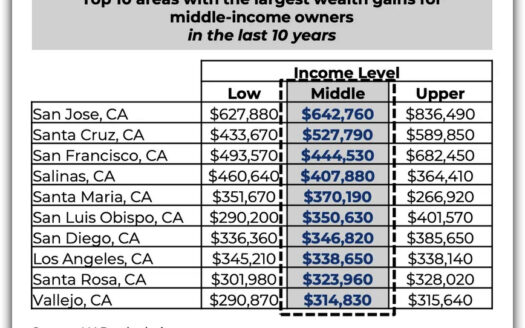

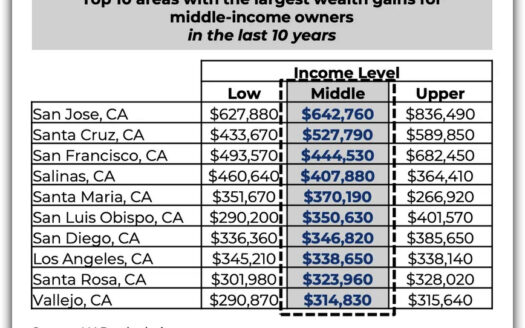

Another Reason For Homeownership

How does homeownership build wealth? It promotes wealth building by acting as a forced savings mechanism and throug [more]

Continue Reading

The Best U.S. City To Retire With No Savings

According to a GoBankingRates survey, one-third of Americans have $500 or less saved, meaning if they were to retir [more]

Continue Reading

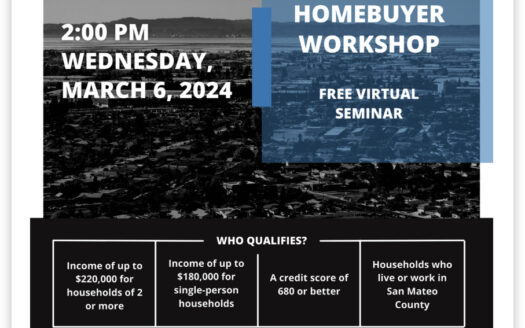

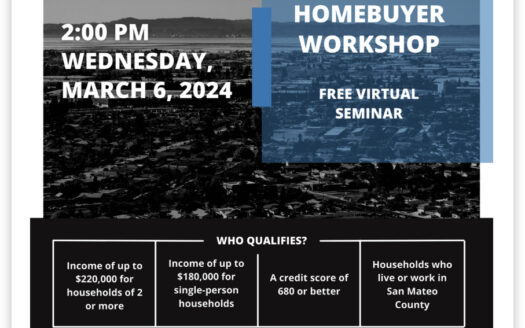

5% Down For Up To $1.2 Million

Sign up fo a free virtual HEART/Meriwest first time homebuyer workshop on Wednesday March 6, 2pm–3pm. Find ou [more]

Continue Reading

California Dream For All Shared Appreciation...

The Dream For All Shared Appreciation Loan is a down payment assistance program for first-time homebuyers to be used in conjunction with the Dream For All Conventional first mortgage for down payment [more]

Continue Reading

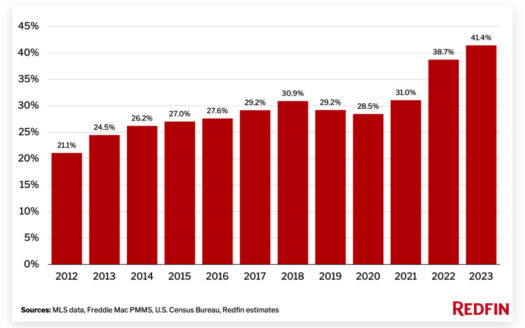

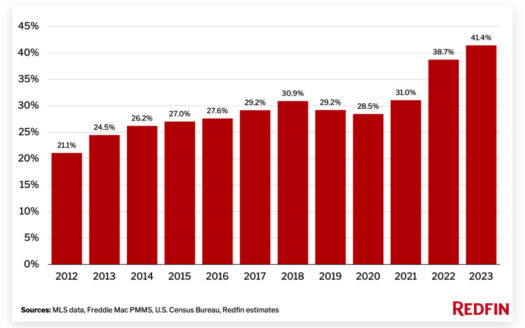

Least Affordable For Buyers In 11 Years: The...

Why? High home prices due to lower-than-normal housing supply, higher mortgage rates, high inflation and homebuyers [more]

Continue Reading

California Home Prices Highest In 15...

According to the California Association of Realtors, the statewide medium home price registered its biggest year-over-year gain in 15 months. What does this mean? Buyers and Sellers: There is solid in [more]

Continue Reading

Coming Real Soon

Welcome to a property that has undergone a remarkable transformation, offering stunning updates. The exterior featu [more]

Continue Reading

Sales in the U.S. vs The SF Bay Area

The home sales for the US are 4.3 million with a median sales price of $396,100. Here on the West Coast, sales incr [more]

Continue Reading

The “Happiest Cities” In The US,...

WalletHub researched 180 of the biggest cities in the US and the happiest city is Fremont, California for the second year in a row, and San Jose came in second. Three key determinants are emotional an [more]

Continue Reading

Low Home Sales Bottoming Out

Let’s take a look at the reasons why and what the latest NAR report show that helps us understand this: Looks [more]

Continue Reading