Advanced Search

Your search results

Blog Archives

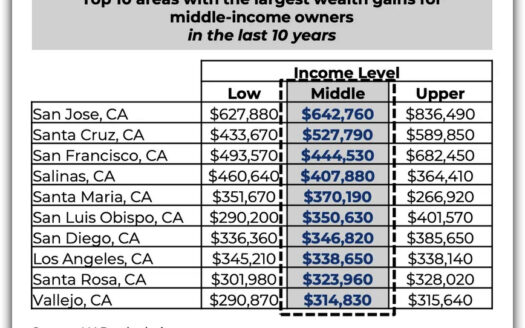

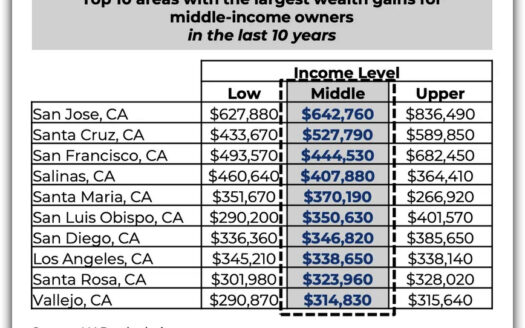

Another Reason For Homeownership

How does homeownership build wealth? It promotes wealth building by acting as a forced savings mechanism and throug [more]

Continue Reading

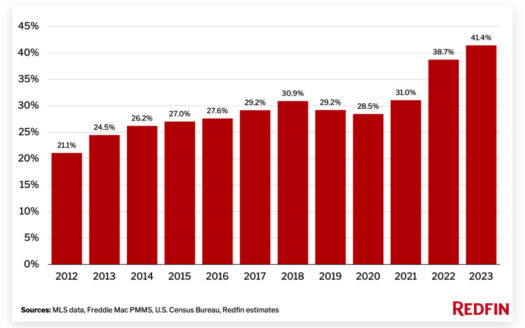

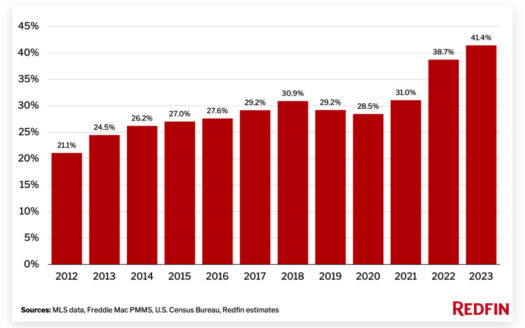

Least Affordable For Buyers In 11 Years: The...

Why? High home prices due to lower-than-normal housing supply, higher mortgage rates, high inflation and homebuyers [more]

Continue Reading

Sales in the U.S. vs The SF Bay Area

The home sales for the US are 4.3 million with a median sales price of $396,100. Here on the West Coast, sales incr [more]

Continue Reading

Your Biggest Asset-Maintain It!

What is Maintenance? Be aware of what needs to be fixed, upgraded, or completely replaced. Keep track on when you b [more]

Continue Reading

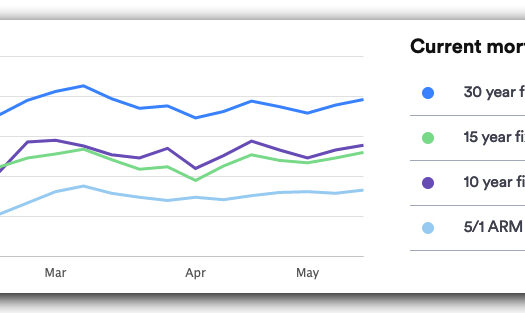

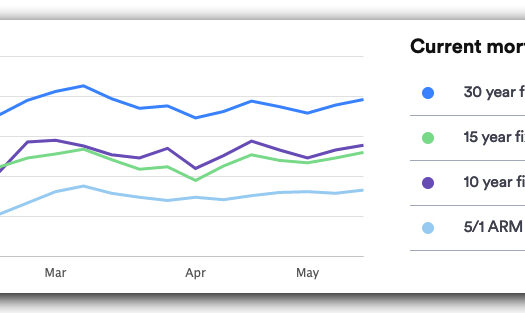

The “Sweet Spot” of Interest Rat...

Mortgage rates have a direct impact on what a potential buyer qualifies for. Real estate 101 says the higher the ra [more]

Continue Reading

Your Atherton Update

Home sold prices in one of the most expensive zip codes in the US for the past few months range from a “very afford [more]

Continue Reading

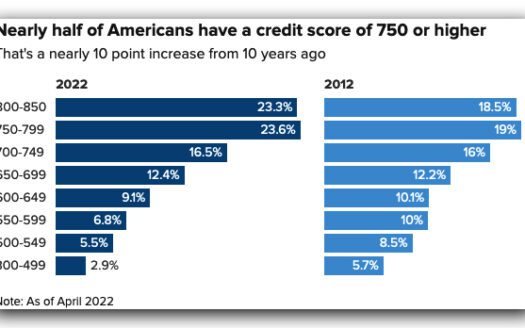

$$ Save Thousands of Dollars $$

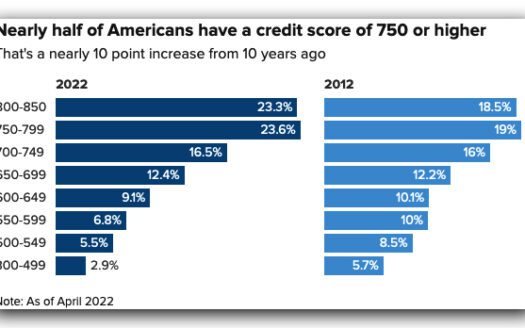

How? Your credit score matters. Generally speaking, the higher your credit score, the better you can get approved f [more]

Continue Reading

May Home Sales–2022

The May home sales numbers are in and Pending Sales had the worst decline since the pandemic shutdown in California [more]

Continue Reading

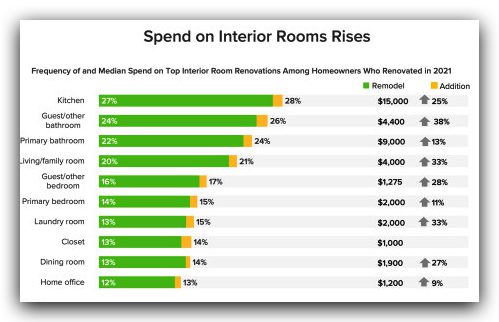

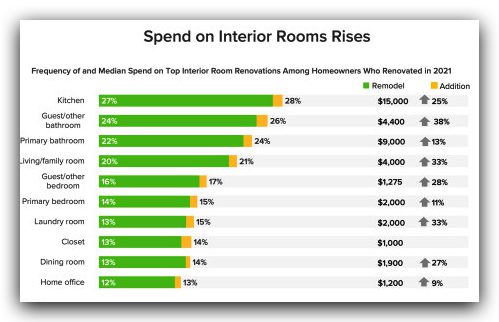

Most Popular Interior Remodels

The above picture shows where homeowners have spent and on what interior space remodels they have done in 2021. The [more]

Continue Reading

What Is an Off-Market Property?

What is it? An off market property can be a home not currently for sale. However this term can also mean a house th [more]

Continue Reading